can you pay california state taxes in installments

You owe 50000 or less in combined tax penalties and interest and filed all. An installment agreement can prevent the IRS from taking enforced collection action.

Sample House Property Tax Bill

Make your check or money order payable to the.

. By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO. If You Owe Taxes Get A Free Consultation for IRS Tax Relief. If you are an individual you may qualify to apply online if.

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. Under a Guaranteed Installment Agreement there is no minimum monthly payment as long as you pledge to pay off your balance within three years. Resolve your tax issues permanently.

Ad Dont Face the IRS Alone. This includes if you have a debt less than 10000 but dont qualify for a guaranteed. Get free competing quotes from the best.

I have installments set up for my federal taxes but I did not see an option for California state taxes. An application fee of 34 will be added. Complete Edit or Print Tax Forms Instantly.

Long-term payment plan installment agreement. Youll still owe penalties. Vouchers to pay your estimated tax by mail.

Typically you will have up to 12 months to pay off your balance. Paying in installments allows you to manage your. It may take up to 60 days to process your request.

If one of these events has happened and you are simply unable to pay. Ad Complete Tax Forms Online or Print Official Tax Documents. In order to qualify you must.

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. Businesses typically have to repay what is due within. If you owe taxes to the State of California but you cant pay the entire amount by the deadline you might be able to set up a payment plan.

Yes you can use the APs income tax payment plan to pay what you owe over time in government taxes. As an individual youll have to pay a 34 setup fee which will be added to your balance when you set up a payment plan. You can apply online at IRSgov or by mail using Form 9465 -FS.

If your tax debt is up to 50000 you can apply for a streamlined installment agreement. Use Estimated Tax for Individuals Form 540-ES 5. Box 2952 Sacramento CA 95812-2952.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at11.00.22AM-1f51d54182cb40b0b110e0940688fbb8.png)

Form 6252 Installment Sale Income Definition

Irs Letter 4458c Second Installment Agreement Skip H R Block

Secured Property Taxes Treasurer Tax Collector

Can I Pay Taxes In Installments

/9465-700bb91065234917b8d2866f2306afe9.jpg)

Form 9465 Installment Agreement Request Definition

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

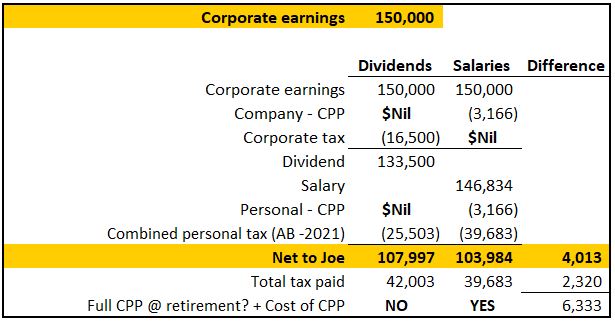

Paying Yourself As A Business Owner Salaries Or Dividends Ah Cpas

Irs Form 9465 Guide To Installment Agreement Request

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

When Does It Make Sense To Elect Out Of The Installment Method

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal